General Average is a longstanding maritime principle that ensures all stakeholders share losses when a ship encounters peril. However, most logistics service providers have limited knowledge of its implications.

This week's eTower Observer delves into the concept of General Average through the lens of two recent cases. We explore what General Average entails, its relationship with cargo insurance, and the benefits of WallTech solutions - CargoWare for risk prevention and efficient claims management.

On May 27th, 2024, CMA CGM issued an urgent notice: the "NORTHERN JUVENILE" vessel, under its charter, caught fire shortly after departing from Singapore port.

The "NORTHERN JUVENILE" was deployed on the ASAFGR route from Asia to West Africa, with a capacity of 8814 TEU, fully loaded with goods. It passed through major domestic ports such as Qingdao, Shanghai, Ningbo, and Nansha. This fire incident affects the vessel's schedule and may impact several co-loading shipping companies, including CMA CGM, Maersk, COSCO, Hapag-Lloyd, and OOCL.

In the announcement, CMA CGM emphasized that it has promptly applied for assistance and signed a LOF salvage contract. However, according to maritime law, unless it can be proven that the carrier's fault caused the fire, the shipowner and shipping company will not be liable for any compensation.

Historical cases suggest that the shipowner may declare a General Average, meaning cargo owners may not only be unable to receive compensation but also have to bear additional costs.

So, What is General Average?

Once the shipowner declares the General Average, preparations must be made immediately.

In simple terms, the General Average means that if a ship encounters an incident, all stakeholders involved in the voyage must share the losses.

General Average (G.A.) is a longstanding maritime legal system that comes into play when a ship faces natural dangers during a voyage, and the captain takes emergency actions, such as jettisoning cargo. These actions result in shared losses among the ship and cargo parties based on the value of their respective properties.

Once the General Average is declared, a professional adjuster calculates the contributions each stakeholder must make. This process involves strict procedures, including declaring a G.A., appointing an adjuster, and obtaining guarantees. Cargo owners must provide guarantees to release their goods, often causing delays and complications.

In these situations, having insurance is crucial as it directly impacts how risks and costs are managed. Without insurance, cargo owners bear the full burden of general average contributions, making the process more challenging and costly.

1. With Insurance

The cargo owner/freight forwarder contacts their insurance company and fills out the "Average Guarantee" form.

Advantages:

- No need to provide cash as a guarantee, reducing cash flow pressure.

- Guarantees issued by insurance companies are highly accepted by shipowners and adjustment companies.

Notes: Ensure that the insurance contract includes general average coverage.

2. Without Insurance

The cargo owner/freight forwarder must provide a cash guarantee for the general average, usually calculated as (cargo value + freight) * (10-20%), paid to a third-party agency.

Challenges:

- Cash guarantees can strain cash flow, with no certainty on when the guarantee will be returned.

- The cargo can only be released and delivered after the average adjuster receives the deposit/guarantee and notifies the shipowner.

In both scenarios, having insurance simplifies the process and alleviates financial pressure on cargo owners.

Real Case: the Baltimore Bridge Collapse Incident

Cargo owners faced huge compensation

In 2024, the globally watched Baltimore Bridge collapse incident saw the Singaporean shipowner of the "Dali" vessel declare a General Average. The vessel carried 4659 containers. Costs related to towing, salvage, removing bridge debris, unloading for weight reduction, repairing the ship, any cargo damage, and container losses will be considered general average and need to be shared by the cargo owners.

Shipping analyst Lars Jensen warned on LinkedIn that cargo owners with shipments on the "Dali" should have sufficient insurance to avoid huge compensation risks.

Duncan Cox, Head of North American Marine Claims at Marsh McLennan, noted that when the General Average contribution exceeds the cargo value, cargo owners usually choose to abandon the cargo. Overall, this incident is expected to involve billions of dollars in compensation.

If the cargo is covered by insurance, cargo owners can claim from their insurance company, which will compensate the cargo owner's share of the general average within the policy limit. In such cases, most of the losses will be borne by the insurance company.

Without insurance, cargo owners must bear their share of the general average, which often exceeds the cargo value itself.

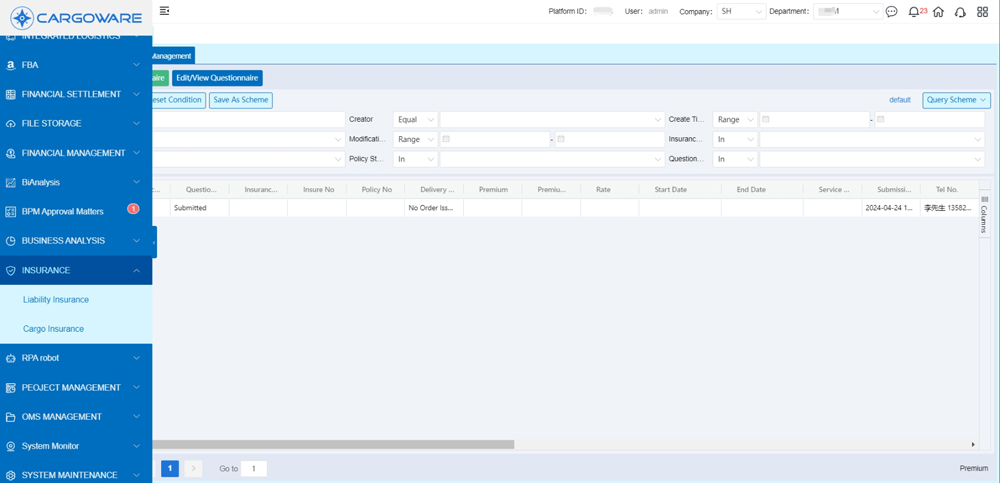

WallTech's freight forwarding and logistics cloud software, CargoWare, features the "Online Insurance" function:

allowing users to complete the insurance process directly within the system, greatly improving operational efficiency without switching to other websites/systems.

The CargoWare system interface intuitively displays the rates, service items, and discount policies of service providers, enabling users to comprehensively compare and select the most suitable provider and make the best decision.

In the claims stage, professional insurance service consultants provide 1-on-1 full support, collaborating with financial, logistics, and legal experts to offer reasonable loss prevention advice and assist clients with claims materials and processes, on-site inspections, and damage assessments, ensuring peace of mind for clients.

The "One-Click Insurance" supported business types include:

- Ocean Freight (Import/Export)

- Air Freight (Import/Export)

- Rail Freight (Import/Export)

- Integrated Logistics (Cross-border trucking, drayage, less-than-truckload, etc.)

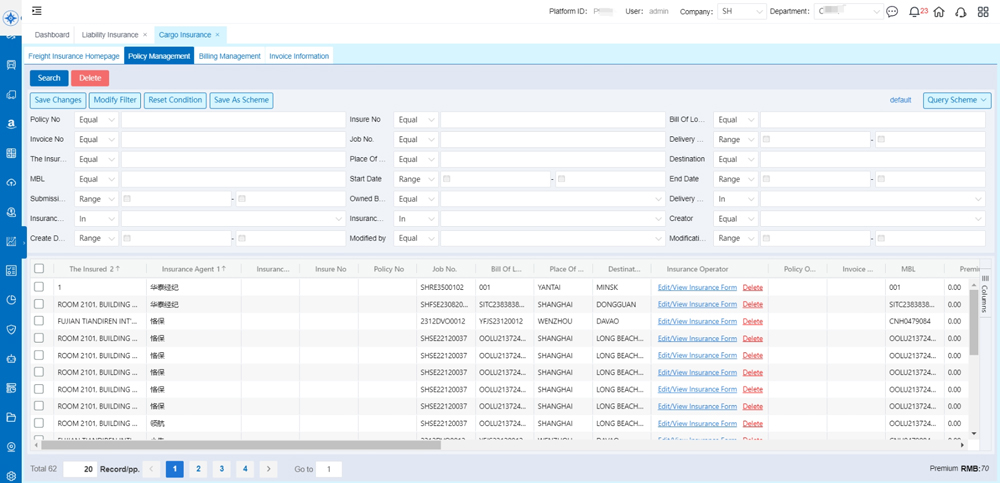

Through the "Policy Management" module in the system, users can see the latest insurance progress, bill information in real-time, and directly download related policy documents and bill invoices.

Simply entering the policy number, bill of lading number, or business code will allow users to check the latest business insurance status with one click.

Cargo owners no longer need to chase operators or customer service to inquire about insurance status. Regardless of who places the order, the current business-related insurance records are clearly visible. Managers also do not need to visit third-party pages to check insurance status; what you see on the insurance page is what you get.

_20250415161350.webp)